The Unseen Burden: Navigating Business Inventory Property Tax

In the intricate tapestry of business operations, companies meticulously track sales, manage supply chains, and optimize production. Yet, a less visible, often underestimated financial obligation lurks in the background for many: the business inventory property tax. Unlike income tax, which taxes profits, or sales tax, which is levied on transactions, inventory property tax is an ad valorem tax – a tax based on value – assessed on the tangible personal property a business holds as inventory. For businesses operating in jurisdictions where it exists, this tax can represent a significant, recurring cost, impacting cash flow, strategic decisions, and overall competitiveness.

Understanding, managing, and mitigating the impact of business inventory property tax is not merely a compliance issue; it’s a strategic imperative. This article delves into the complexities of this often-overlooked tax, exploring its nature, its profound impact on businesses, and the strategies companies can employ to navigate its challenges effectively.

What is Business Inventory Property Tax?

At its core, business inventory property tax is a local tax levied by state, county, or municipal governments on the value of a company’s raw materials, work-in-process, and finished goods held for sale or consumption in the ordinary course of business. It falls under the broader umbrella of "personal property tax," distinguishing it from real estate property tax which applies to land and buildings.

The fundamental characteristics of this tax include:

- Ad Valorem Nature: The tax amount is directly proportional to the assessed value of the inventory.

- Assessment Date: The value of inventory is typically assessed on a specific "assessment date," often January 1st or July 1st, meaning the tax is based on a snapshot of inventory levels on that particular day.

- Local Jurisdiction: Unlike federal or state income taxes, inventory property taxes are almost exclusively administered at the local level, leading to significant variations in rules, rates, and exemptions across different jurisdictions, even within the same state.

- Tangible Personal Property: It applies only to physical goods, not to intangible assets like intellectual property or goodwill.

The calculation generally involves three key components:

- Valuation: The assessor determines the market value of the inventory. This can be based on cost, depreciated cost, or other methods, often requiring businesses to report inventory values as of the assessment date.

- Assessment Ratio: A percentage applied to the market value to arrive at the assessed value.

- Millage Rate (or Tax Rate): A rate, expressed as dollars per thousand dollars of assessed value (or a percentage), applied to the assessed value to determine the final tax liability.

For example, if a business holds $1,000,000 in inventory, in a jurisdiction with a 50% assessment ratio and a 20 millage rate, the calculation would be:

$1,000,000 (Market Value) 0.50 (Assessment Ratio) = $500,000 (Assessed Value)

$500,000 (Assessed Value) (20/1000) (Millage Rate) = $10,000 (Tax Liability)

The Profound Impact on Businesses

The presence of business inventory property tax creates a multi-faceted burden that extends far beyond the direct tax payment.

1. Financial Strain and Cash Flow Implications

Perhaps the most immediate impact is the direct financial cost. Unlike income tax, which is tied to profitability, inventory tax is levied on an asset regardless of whether it has been sold or generated revenue. This means businesses are paying tax on capital that is essentially sitting idle, tying up working capital and potentially straining cash flow, especially for companies with high inventory turnover or those in cyclical industries. For startups or businesses with thin margins, this upfront cost can be particularly challenging. It can also be seen as a form of "double taxation," as the inventory’s value is also reflected in the eventual sales revenue, which is subject to income tax.

2. Administrative Complexity and Compliance Burden

Navigating the labyrinth of inventory property tax rules is a significant administrative undertaking. Businesses must:

- Maintain meticulous inventory records, often requiring segregation of inventory by type, location, and even ownership (e.g., consigned goods).

- Understand and comply with varying reporting requirements, forms, and deadlines across different jurisdictions.

- Accurately value inventory, which can be complex for work-in-process, obsolete goods, or items with fluctuating market prices.

- Prepare for potential audits, which demand robust documentation and justification for reported values.

The resources dedicated to compliance – time, personnel, and software – can divert valuable resources from core business activities.

3. Strategic Disincentives and Economic Impact

The existence of this tax can subtly, yet powerfully, influence strategic business decisions:

- Inventory Levels: Businesses may be incentivized to reduce inventory levels, particularly around assessment dates, to minimize tax liability. While this might align with Just-In-Time (JIT) principles, it can also compromise supply chain resilience, increase the risk of stockouts, and limit the ability to leverage bulk purchasing discounts.

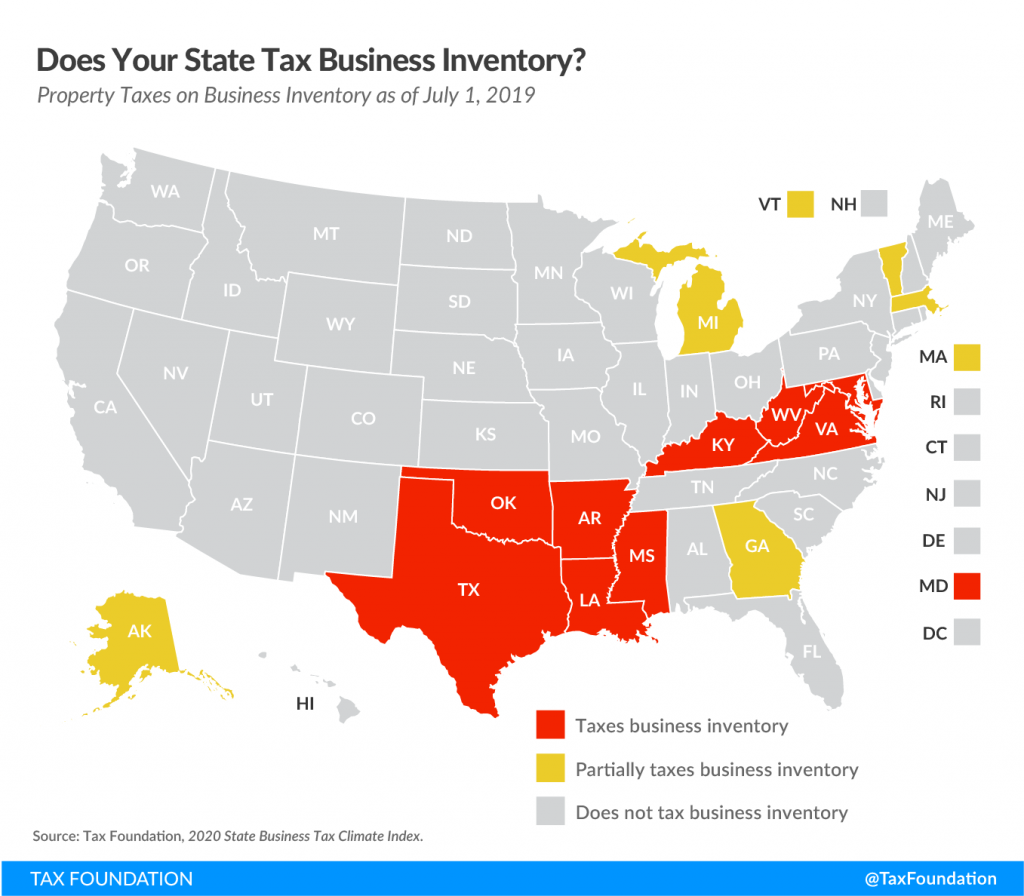

- Location Decisions: Companies evaluating new manufacturing plants, distribution centers, or retail outlets often factor in the presence or absence of inventory property tax when choosing a location. States or counties that have abolished or significantly exempted this tax gain a competitive advantage in attracting and retaining businesses.

- Competitiveness: Businesses in jurisdictions with inventory tax may face higher operating costs compared to competitors in tax-free zones, potentially impacting pricing strategies and market share. This is particularly relevant for manufacturers and distributors.

- Investment in Capital Goods: While not directly on inventory, the broader personal property tax (which often includes inventory) can discourage investment in machinery and equipment, impacting productivity and technological advancement.

4. Valuation Disputes and Appeals

Disagreements over inventory valuation are common. Factors such as obsolescence, damage, or changes in market conditions can significantly affect an item’s true value, yet assessors may rely on simpler, formulaic approaches. Businesses often find themselves needing to appeal assessments, which requires detailed evidence and a thorough understanding of local appeal processes, adding further to administrative costs and uncertainty.

Strategies for Effective Management and Mitigation

Given its pervasive impact, proactive management of business inventory property tax is crucial. Companies can adopt several strategies to minimize their liability and ensure compliance:

1. Robust Inventory Management Systems

Accurate and detailed inventory records are the bedrock of effective property tax management. Businesses should implement systems that:

- Track inventory by type (raw materials, WIP, finished goods), location, and ownership status.

- Segregate taxable inventory from non-taxable assets (e.g., consigned goods, inventory held for others, or items subject to specific exemptions).

- Provide historical data to support valuation adjustments for obsolescence or damage.

- Can generate reports reflecting inventory levels as of specific assessment dates.

2. Strategic Inventory Planning

While not always feasible or desirable, businesses can explore strategies to optimize inventory levels around assessment dates:

- Just-In-Time (JIT) principles: While primarily a lean manufacturing strategy, JIT can inherently reduce inventory on hand, thus lowering potential tax liability. However, this must be balanced against supply chain risks.

- Consignment Agreements: If permitted by local statutes, holding inventory on consignment (where the supplier retains ownership until sale) can shift the tax burden to the supplier, or, more likely, render it non-taxable for the holding business.

- Optimizing Shipments: For distributors, timing inbound and outbound shipments to minimize inventory on the assessment date can be a tactical maneuver, though this must be carefully managed to avoid disruptions.

3. Leveraging Exemptions and Incentives

Many jurisdictions offer exemptions or incentives to reduce the inventory tax burden:

- Freeport Exemptions: These are common in many states and exempt inventory that is manufactured, processed, or warehoused in the state for shipment out-of-state. Understanding the specific requirements (e.g., segregation, documentation) is critical.

- Manufacturing Exemptions: Some states exempt raw materials or work-in-process for manufacturers.

- Economic Development Incentives: Local governments may offer abatements or other incentives to attract businesses, which can include relief from inventory property tax for a period.

- State-Specific Abolition: Some states (e.g., Florida, Pennsylvania, New York, Texas for most inventory) have abolished the inventory property tax entirely, making them attractive locations for inventory-heavy businesses.

4. Proactive Engagement with Tax Assessors

Businesses should not passively accept assessment notices. Instead:

- Review Assessments: Promptly review all assessment notices for accuracy, ensuring the correct inventory values, assessment ratios, and exemptions have been applied.

- Understand Local Rules: Be thoroughly familiar with the specific rules, regulations, and reporting requirements of each jurisdiction where inventory is held.

- Appeal Unfair Valuations: If an assessment appears incorrect or excessive, businesses have the right to appeal. This requires preparing a strong case with supporting documentation (e.g., proof of obsolescence, market value data).

- Maintain Open Communication: Establishing a working relationship with local assessors can facilitate understanding and potentially resolve issues before they escalate.

5. Seeking Professional Guidance

Given the complexity and jurisdictional variations, engaging with property tax specialists, consultants, or legal counsel can be invaluable. These professionals can:

- Ensure compliance across multiple jurisdictions.

- Identify potential exemptions and incentives.

- Assist with complex valuation issues and prepare robust appeal arguments.

- Provide strategic advice on inventory management in the context of property tax.

The Broader Policy Debate

The existence of business inventory property tax remains a subject of ongoing policy debate. Proponents argue that it provides a vital revenue source for local governments, funding essential services like schools, public safety, and infrastructure. They also contend that it ensures all property owners contribute to the local tax base.

However, a growing chorus of critics, including many business advocacy groups, argues for its abolition or significant reform. Their arguments center on:

- Economic Disincentive: It discourages investment, job creation, and efficient supply chain management.

- Competitive Disadvantage: It places businesses in taxing jurisdictions at a disadvantage compared to those in tax-free states.

- Administrative Burden: The compliance costs often outweigh the revenue generated, particularly for smaller businesses.

- "Taxing Productivity": It taxes an asset before it generates revenue, rather than taxing actual economic activity or profits.

This debate has led to a trend in some states to reduce or eliminate the tax, recognizing its potential dampening effect on economic growth and business attraction.

Conclusion

Business inventory property tax, while often overshadowed by more prominent tax discussions, represents a significant financial and operational challenge for many companies. Its ad valorem nature, local administration, and impact on cash flow and strategic decisions demand careful attention. By implementing robust inventory management systems, strategically planning inventory levels, diligently seeking exemptions, and proactively engaging with tax authorities, businesses can effectively navigate this complex tax landscape. Ultimately, understanding and strategically managing business inventory property tax is not just about compliance; it is about preserving capital, enhancing competitiveness, and fostering sustainable growth in an increasingly dynamic global economy.