Okay, here is an article about Business Inventory Loans, approximately 1200 words, written in English.

Unlocking Growth: A Comprehensive Guide to Business Inventory Loans

In the dynamic world of commerce, inventory is often described as the lifeblood of a business. Whether you’re a bustling retail outlet, a meticulous manufacturer, a high-volume wholesaler, or a nimble e-commerce venture, having the right products in stock at the right time is paramount to meeting customer demand and driving sales. However, acquiring and maintaining adequate inventory levels can be a significant capital drain, tying up precious cash flow that could otherwise be used for expansion, marketing, or operational improvements. This is where Business Inventory Loans step in, offering a vital financial solution to help businesses leverage their assets and fuel their growth.

This comprehensive guide will delve deep into the world of inventory financing, exploring what these loans are, how they function, the myriad benefits they offer, the potential risks involved, different types available, eligibility criteria, and crucial factors to consider when choosing a lender.

What Exactly Are Business Inventory Loans?

At its core, a Business Inventory Loan, also known as inventory financing or stock-based lending, is a type of short-term working capital loan that uses a company’s unsold inventory as collateral. Unlike traditional business loans that might require real estate, equipment, or accounts receivable as security, inventory loans specifically unlock the value tied up in a business’s goods.

The primary purpose of these loans is to provide businesses with the liquidity needed to purchase, produce, or hold inventory without depleting their operating capital. This allows companies to maintain optimal stock levels, seize opportunities like bulk purchase discounts, navigate seasonal fluctuations, and ultimately, grow their operations.

How Do Business Inventory Loans Work?

The mechanics of an inventory loan involve several key steps and considerations:

- Collateral Assessment: The lender will evaluate the value and salability of your inventory. Not all inventory is created equal in the eyes of a lender. Highly liquid, standardized, and easily marketable goods (like electronics, clothing, or common raw materials) are preferred over highly specialized, perishable, or custom-made items, which are harder to liquidate in case of default.

- Advance Rate: Lenders typically do not lend 100% of the inventory’s value. Instead, they offer an "advance rate," which is a percentage of the inventory’s appraised value. This rate can vary significantly, often ranging from 20% to 80%, depending on the type of inventory, its liquidity, and the lender’s risk assessment. For instance, a lender might offer 70% for finished goods, 50% for work-in-progress, and 30% for raw materials.

- Valuation Methodology: Lenders use various methods to value inventory, including:

- Cost Value: The price paid by the business to acquire or produce the inventory.

- Market Value: The price at which the inventory could be sold in the current market.

- Liquidation Value: The estimated price the inventory would fetch in a quick sale, often at a discount. Lenders usually lean towards the lower end (cost or liquidation value) to protect their interests.

- Lien and Monitoring: Once approved, the lender places a lien on the inventory, meaning they have a legal claim to it until the loan is repaid. Many lenders also require regular inventory reports, conduct periodic audits, or even use technology to monitor inventory levels and movement to ensure the collateral remains sufficient and in good condition.

- Repayment Structure: Repayment terms vary. Some loans require regular fixed payments, while others might be structured where a percentage of sales generated from the financed inventory is remitted to the lender. The loan term is generally short, typically ranging from a few months to a couple of years, aligning with the quick turnover nature of inventory.

Who Benefits from Business Inventory Loans?

Inventory financing is not a one-size-fits-all solution but proves particularly beneficial for specific types of businesses and situations:

- Retailers: To stock up for peak seasons (e.g., holidays), introduce new product lines, or take advantage of vendor discounts.

- Wholesalers & Distributors: To maintain sufficient stock to fulfill large orders quickly and consistently, managing fluctuating demand from their clients.

- Manufacturers: To purchase raw materials, fund work-in-progress, or hold finished goods until they are sold, especially for products with long production cycles.

- E-commerce Businesses: To manage inventory for online sales, which often involve rapid scaling and unpredictable demand spikes.

- Seasonal Businesses: Companies whose sales spike at certain times of the year (e.g., fashion, agricultural products, holiday items) can use inventory loans to build up stock in anticipation of demand without tying up year-round capital.

- Rapidly Growing Businesses: As sales increase, so does the need for inventory. These loans provide the capital to scale inventory quickly to match growth.

- Businesses with Purchase Order Financing Needs: While distinct, inventory loans can complement or be an alternative to PO financing, ensuring a steady supply chain.

Key Benefits of Inventory Financing

For businesses that rely heavily on physical goods, inventory loans offer several compelling advantages:

- Improved Cash Flow: By financing inventory separately, businesses can free up operating cash for other critical expenses like payroll, marketing, or capital expenditures.

- Seize Growth Opportunities: Access to capital allows businesses to expand product lines, enter new markets, or fulfill larger orders they might otherwise have to decline due to lack of inventory.

- Manage Seasonal Demand: Businesses can strategically build up inventory during off-peak seasons, ensuring they are well-stocked and ready to meet high demand when peak season arrives, preventing lost sales.

- Take Advantage of Bulk Discounts: Suppliers often offer significant discounts for large-volume purchases. Inventory loans provide the capital to capitalize on these savings, improving profit margins.

- Optimized Working Capital: Inventory financing helps businesses maintain healthy working capital ratios by converting a non-cash asset (inventory) into liquid funds, improving financial flexibility.

- Alternative to Equity Financing: For business owners hesitant to dilute their ownership, inventory loans offer a debt-based solution to acquire necessary capital without giving up equity.

- Faster Access to Funds: Compared to traditional bank loans, some inventory financing options from alternative lenders can offer quicker approval and funding times, crucial for time-sensitive inventory needs.

Potential Risks and Challenges

While beneficial, inventory loans are not without their drawbacks and require careful consideration:

- Inventory Obsolescence: If the financed inventory becomes outdated, damaged, or unsellable, its value plummets, potentially leaving the business owing money on worthless collateral. This risk is particularly high for fashion, technology, and perishable goods.

- Strict Lender Requirements and Monitoring: Lenders often impose stringent reporting requirements, conduct frequent audits, and may dictate how inventory is stored or managed to protect their collateral. This can add an administrative burden.

- High Costs: Inventory loans can sometimes carry higher interest rates and fees compared to other types of business loans, especially from alternative lenders, reflecting the higher risk associated with inventory as collateral.

- Valuation Discrepancies: The lender’s valuation of inventory might be significantly lower than what the business believes it to be, resulting in a lower advance rate than anticipated.

- Risk of Over-Leveraging: Taking on too much debt relative to the business’s sales velocity can lead to repayment difficulties, especially if inventory turnover slows down.

- Default Consequences: In case of default, the lender has the right to seize and liquidate the inventory, which can severely disrupt operations and potentially lead to business closure.

Types of Inventory Financing

While the core concept remains the same, inventory financing can manifest in a few different forms:

- Revolving Line of Credit: This is one of the most common and flexible forms. A business is approved for a maximum credit limit based on its inventory value. It can draw funds as needed, repay them, and draw again, similar to a credit card. Interest is only paid on the amount drawn. This is ideal for ongoing, fluctuating inventory needs.

- Term Loan: Less common for pure inventory financing, a term loan provides a lump sum that is repaid over a fixed period with regular installments. It might be used for a large, one-time inventory purchase that is expected to sell through steadily. Often, inventory is just one component of collateral for a larger term loan.

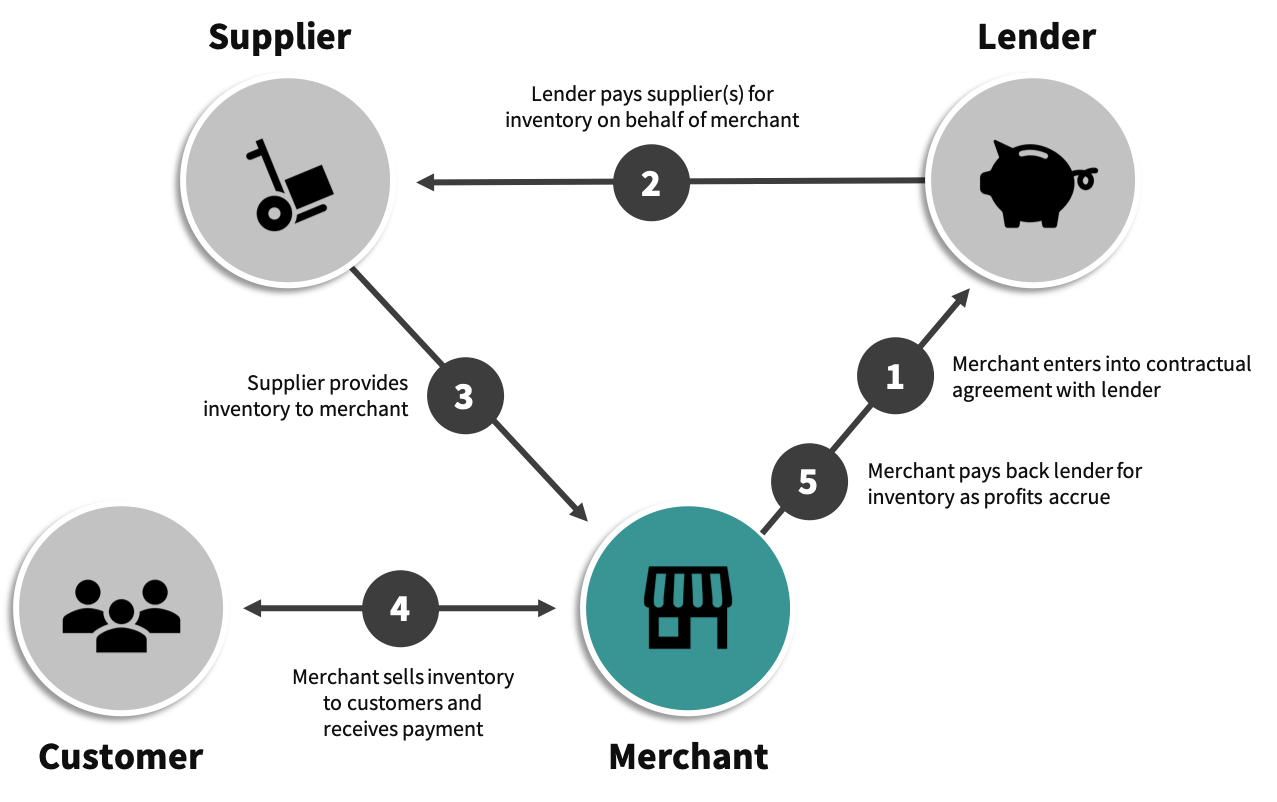

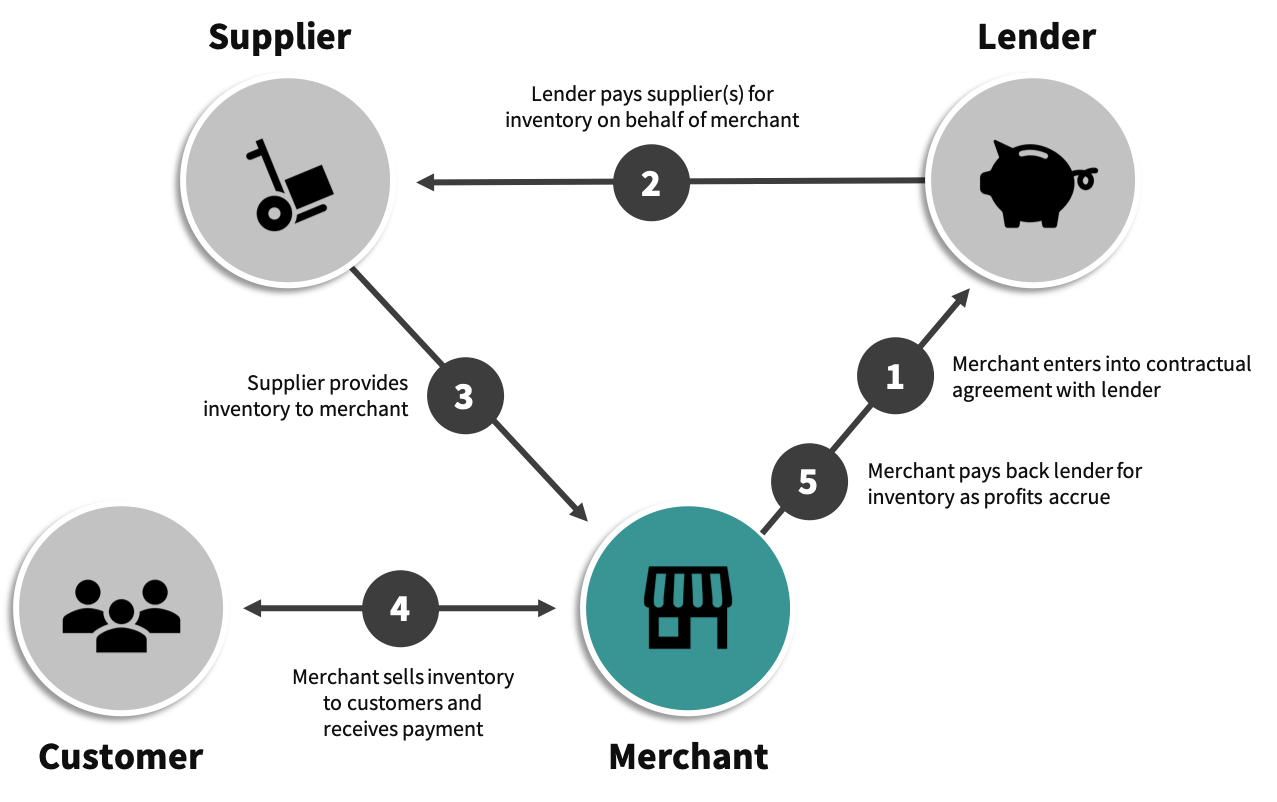

- Purchase Order (PO) Financing: While not strictly an inventory loan, PO financing is a closely related solution. It provides capital to pay suppliers for goods before they are manufactured or delivered, based on a confirmed customer purchase order. The lender pays the supplier directly, and then collects payment from the end customer once the goods are delivered, remitting the balance (minus fees) to the business. This is excellent for fulfilling specific, large orders.

- Floor Planning: A specialized type of inventory financing primarily used by dealerships for high-value, serialized items like vehicles, boats, or large appliances. The lender provides funds to purchase these items, and the loan is repaid as each specific item is sold.

Eligibility Criteria and Application Process

Lenders assess several factors when considering an application for an inventory loan:

- Business History and Creditworthiness: A stable operating history and good business credit score are generally required.

- Inventory Quality: As discussed, the type, salability, and turnover rate of the inventory are critical. Lenders prefer finished goods over raw materials and fast-moving inventory over slow-moving stock.

- Inventory Management Systems: Lenders want to see robust inventory management practices, including accurate tracking, forecasting, and control systems.

- Financial Health: Consistent revenue, profitability, and positive cash flow are indicators of a business’s ability to repay the loan.

- Industry Stability: Some industries are viewed as riskier than others due to volatility or rapid obsolescence.

The application process typically involves: submitting financial statements, inventory reports (ageing, valuation), business plans, and potentially personal financial information. The lender will conduct due diligence, including an inventory appraisal, before offering terms.

Choosing the Right Inventory Loan Provider

Selecting the right financing partner is crucial. Consider the following:

- Interest Rates and Fees: Compare the total cost of the loan, including interest, origination fees, monitoring fees, and any other charges.

- Advance Rates: Understand how much of your inventory’s value the lender is willing to advance.

- Repayment Terms: Ensure the repayment schedule aligns with your business’s cash flow cycles and expected inventory turnover.

- Lender Experience and Reputation: Choose a lender with a proven track record in inventory financing and a good reputation for transparency and customer service.

- Flexibility: Does the lender offer flexible terms that can adapt to your business’s changing needs?

- Industry Understanding: A lender who understands your specific industry can offer more tailored and favorable terms.

Optimizing Inventory Management Alongside Financing

An inventory loan is a powerful tool, but its effectiveness is amplified when coupled with sound inventory management practices. Businesses should continuously strive to:

- Improve Forecasting Accuracy: Use data analytics to predict demand more accurately, reducing the risk of overstocking or understocking.

- Implement Robust Inventory Tracking: Utilize ERP systems, inventory management software, or even advanced RFID technology to maintain real-time visibility of stock levels.

- Optimize Turnover Rates: Aim for a healthy inventory turnover rate, ensuring goods are sold efficiently to minimize holding costs and obsolescence risk.

- Develop Strong Supplier Relationships: Negotiate favorable terms, reliable delivery schedules, and potential consignment options to reduce upfront capital requirements.

- Conduct Regular Audits: Periodically reconcile physical inventory with records to identify discrepancies and prevent losses.

Conclusion

Business Inventory Loans represent a strategic financial instrument for businesses that rely on their stock to generate revenue. By transforming static inventory into dynamic working capital, these loans empower companies to enhance cash flow, capitalize on growth opportunities, and navigate market fluctuations with greater agility. However, like any financial leverage, they come with inherent risks that demand careful consideration, diligent management, and a clear understanding of the terms involved.

When used wisely, in conjunction with robust inventory management practices and a trusted lending partner, inventory financing can be a powerful catalyst, unlocking the true potential of your assets and paving the way for sustainable business growth and success. For many businesses, the ability to effectively manage and finance their inventory is not just a competitive advantage—it’s a fundamental pillar of their enduring prosperity.