Navigating Growth: A Comprehensive Guide to Business Inventory Loans

In the dynamic world of business, inventory is both a critical asset and a significant liability. It represents the lifeblood of retail, manufacturing, and distribution, ensuring products are available to meet customer demand. However, acquiring and maintaining adequate inventory often ties up substantial working capital, creating a delicate balancing act for businesses aiming for growth without compromising liquidity. This is where the business inventory loan emerges as a powerful and strategic financial tool.

A business inventory loan is a specific type of financing designed to help companies purchase or produce goods for sale. Unlike general working capital loans, these facilities are often secured by the very inventory they help acquire, making them a specialized solution for businesses whose core operations revolve around the movement of goods. For many entrepreneurs, understanding the intricacies of inventory loans can unlock significant opportunities for expansion, improved cash flow, and enhanced operational efficiency.

The Crucial Role of Inventory in Business Operations

Before diving into the mechanics of inventory loans, it’s essential to appreciate the multifaceted role inventory plays. For retailers, sufficient stock prevents lost sales and customer dissatisfaction. Manufacturers rely on raw materials and work-in-progress inventory to maintain production schedules. Wholesalers and distributors need ample finished goods to fulfill orders promptly. In essence, inventory is the bridge between supply and demand, a tangible representation of a company’s ability to serve its market.

However, carrying inventory comes at a cost. Beyond the initial purchase price, businesses incur expenses related to storage, insurance, potential obsolescence, and the opportunity cost of capital tied up in unsold goods. The challenge lies in optimizing inventory levels – having enough to meet demand without overstocking and draining valuable cash resources. This is precisely the dilemma an inventory loan seeks to resolve.

What is a Business Inventory Loan?

At its core, a business inventory loan provides capital specifically for the acquisition or production of inventory. Lenders typically use the inventory itself as collateral, which can make these loans more accessible and potentially offer better terms than unsecured alternatives, especially for businesses with limited other tangible assets. The loan amount is usually a percentage of the inventory’s value, known as the loan-to-value (LTV) ratio, which can vary depending on the type of inventory, its marketability, and the lender’s risk assessment.

There are several variations of inventory financing, each tailored to different business needs:

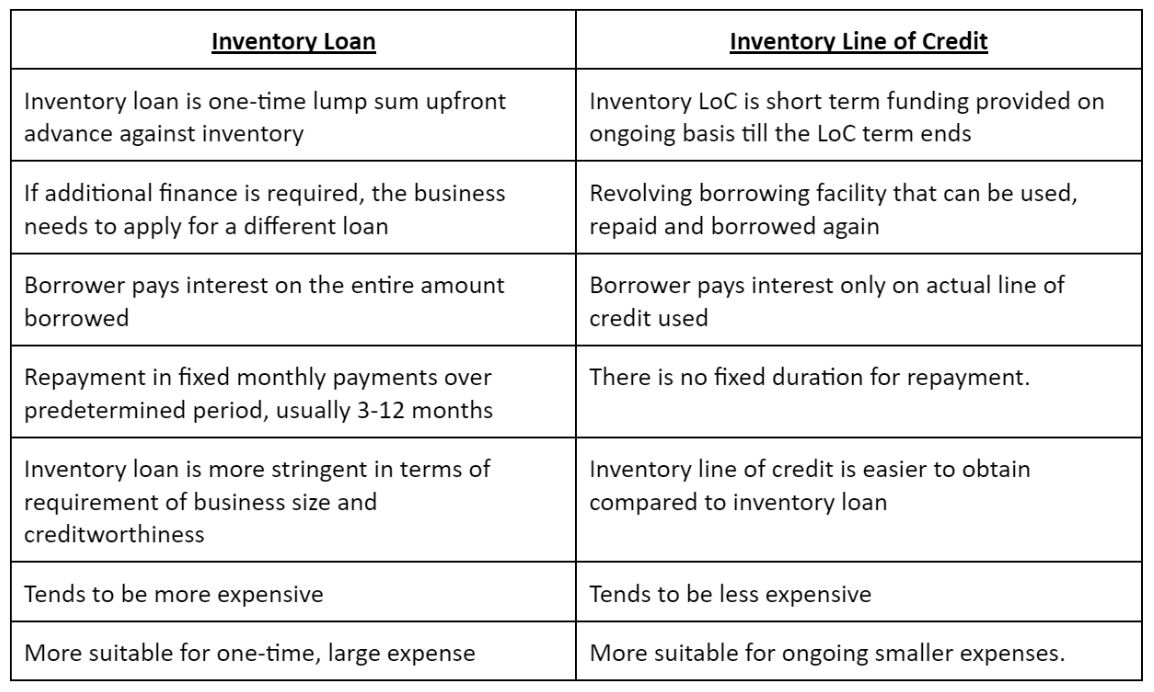

- Traditional Inventory Loans (Term Loans): These are straightforward loans for a fixed amount, paid back over a set period with regular installments. They are suitable for businesses needing to make a large, one-time inventory purchase, perhaps for a new product launch or a major seasonal stock-up.

- Inventory Lines of Credit (Revolving): More flexible than term loans, an inventory line of credit allows businesses to borrow, repay, and re-borrow up to a certain limit. This is ideal for managing fluctuating inventory needs throughout the year, such as seasonal peaks and troughs, offering continuous access to capital as inventory cycles.

- Purchase Order (PO) Financing: This type of financing isn’t strictly an inventory loan but is closely related. It provides capital to pay suppliers for goods once a confirmed customer purchase order is in hand. The lender essentially funds the cost of goods sold, ensuring the supplier is paid and the order can be fulfilled, with repayment coming from the customer’s payment.

- Floor Planning: Common in industries with high-value, slow-moving inventory like car dealerships or heavy equipment sales, floor planning finances individual units of inventory. As each unit is sold, the corresponding portion of the loan is repaid.

Why Businesses Need Inventory Loans: Key Use Cases

Businesses leverage inventory loans for a variety of strategic and operational reasons:

- Managing Seasonal Fluctuations: Retailers preparing for holiday seasons, fashion businesses stocking up for spring/fall collections, or agricultural suppliers buying seeds and fertilizers – all face predictable periods of high inventory demand. An inventory loan provides the necessary capital to meet these surges without depleting operational cash.

- Scaling and Growth: As a business expands into new markets or experiences increased demand, it needs more inventory. An inventory loan facilitates this growth, ensuring product availability keeps pace with sales opportunities.

- Seizing Bulk Purchase Discounts: Suppliers often offer significant discounts for large volume orders. An inventory loan allows businesses to take advantage of these cost-saving opportunities, improving profit margins.

- Launching New Products: Introducing a new product line requires an initial investment in raw materials or finished goods. Inventory financing can fund this crucial first stock, enabling a smooth market entry.

- Bridging Cash Flow Gaps: Sometimes, a business may have strong sales but slow-paying customers, creating a gap between paying suppliers and receiving customer payments. An inventory loan can bridge this gap, ensuring continued supply chain operations.

- Maintaining Optimal Stock Levels: Rather than understocking and losing sales or overstocking and incurring high carrying costs, an inventory loan helps businesses maintain the right level of inventory to optimize efficiency and profitability.

Advantages of Securing an Inventory Loan

For the right business, inventory loans offer several compelling advantages:

- Access to Specific Capital: Unlike general business loans, inventory financing is tailored to a very specific need, making it easier to secure for companies whose primary assets are their goods.

- Improved Cash Flow: By financing inventory purchases, businesses can free up their operating cash for other critical expenses like payroll, marketing, or overheads, leading to better liquidity management.

- Potentially Lower Interest Rates: Because the loan is secured by tangible assets (the inventory), lenders perceive less risk. This can translate into more favorable interest rates and terms compared to unsecured loans, especially for newer businesses or those with less established credit.

- Preservation of Other Assets: Businesses don’t need to pledge other valuable assets like real estate or machinery as collateral, preserving them for other financing needs or simply retaining full ownership.

- Quick Funding: Some specialized inventory lenders, particularly online platforms, can process applications and disburse funds relatively quickly, which is crucial when time-sensitive opportunities arise.

Understanding the Risks and Considerations

While beneficial, inventory loans are not without their risks and require careful consideration:

- Inventory Obsolescence and Depreciation: This is perhaps the biggest risk. If the inventory becomes outdated, damaged, or loses market value before it’s sold, its collateral value diminishes, potentially leaving the business with insufficient funds to repay the loan. This is particularly relevant for technology, fashion, or perishable goods.

- Valuation Challenges: Lenders will conduct their own appraisal of inventory value, which might be more conservative than a business’s internal valuation. The loan amount will be based on this assessed value, typically at a discount (e.g., 50-80% of wholesale value).

- Interest Rates and Fees: While potentially lower than unsecured loans, inventory financing still comes with interest charges and various fees (origination fees, administrative fees, appraisal fees). Businesses must thoroughly understand the total cost of borrowing.

- Collateral Requirements and UCC Filings: Lenders will place a lien on the inventory (typically through a Uniform Commercial Code or UCC filing). In case of default, the lender has the right to seize and sell the inventory to recover their funds.

- Reporting Requirements: Lenders often require regular, detailed reports on inventory levels, sales, and turnover to monitor the collateral. This can add an administrative burden to the borrower.

- Minimum Inventory Levels: Some agreements may stipulate minimum inventory levels that must be maintained, which can restrict a business’s flexibility.

Who is an Inventory Loan Best Suited For?

Inventory loans are most effective for businesses that:

- Operate in retail, e-commerce, manufacturing, wholesale, or distribution: These industries inherently rely on significant inventory levels.

- Have predictable sales cycles and inventory turnover: Businesses with a clear understanding of their sales patterns can better manage their inventory and repayment schedules.

- Deal with marketable, non-perishable goods: Inventory that holds its value and can be readily sold by the lender if necessary is more attractive as collateral. Highly customized, perishable, or rapidly obsolescent goods pose higher risks.

- Are experiencing growth or seasonal demand spikes: Companies looking to capitalize on increased opportunities without straining cash flow are ideal candidates.

- Have a solid understanding of their inventory management: Effective inventory tracking and control are crucial for managing the loan and meeting lender requirements.

The Application Process and What Lenders Look For

Applying for an inventory loan typically involves providing comprehensive financial and operational data. Lenders will scrutinize several key areas:

- Business History and Financial Health: This includes financial statements (profit and loss, balance sheet, cash flow statements), tax returns, and projections. Lenders want to see a stable, profitable business with a clear ability to generate revenue.

- Creditworthiness: Both business credit scores and the personal credit scores of key principals will be assessed.

- Inventory Reports: Detailed reports on current inventory, including age, value (cost vs. market), turnover rates, and any existing liens. This is crucial for assessing the quality and liquidity of the collateral.

- Sales History and Forecasts: Proof of consistent sales and realistic projections helps lenders gauge the likelihood of the inventory being sold and the loan being repaid.

- Management Experience: The experience and track record of the management team in their industry can instill confidence in lenders.

- Existing Debt: An overview of all outstanding debts helps lenders understand the company’s overall financial leverage.

The application process often includes an initial consultation, submission of required documents, a due diligence phase (which may include an inventory audit or appraisal), and finally, loan approval and funding.

Choosing the Right Lender and Loan Structure

Selecting the appropriate lender and loan structure is paramount. Businesses should consider:

- Type of Lender: Traditional banks often offer lower rates but have stricter qualification criteria and longer approval processes. Online lenders and specialized asset-based lenders (ABLs) may be more flexible and faster, albeit potentially with higher rates.

- Interest Rates and Fees: Compare the annual percentage rate (APR) and all associated fees to understand the true cost of the loan.

- Loan-to-Value (LTV) Ratio: Understand what percentage of your inventory’s value the lender is willing to finance.

- Repayment Terms: Assess the flexibility of repayment schedules and whether they align with your sales cycles.

- Reporting Requirements: Be clear about the ongoing reporting obligations and ensure your internal systems can meet them.

- Lender’s Industry Expertise: A lender with experience in your specific industry will better understand your challenges and inventory cycles.

Conclusion

Business inventory loans are more than just a source of capital; they are strategic financial instruments that empower businesses to manage their most crucial asset effectively. By providing the necessary funding to acquire, produce, and maintain optimal stock levels, these loans enable companies to seize growth opportunities, navigate seasonal demands, and improve overall cash flow. However, like any financial tool, they come with inherent risks, primarily related to inventory obsolescence and valuation.

For businesses operating in inventory-intensive sectors, a well-structured inventory loan, chosen after careful consideration of terms, costs, and personal business needs, can be a game-changer. It allows entrepreneurs to transform potential into profit, ensuring that their shelves are never empty and their production lines never halt, ultimately fostering stability and sustainable growth in a competitive marketplace. Understanding and strategically utilizing business inventory loans is a hallmark of sophisticated financial management, paving the way for sustained success.