Inventory Rich, Cash Poor: The Hidden Peril of Overstocked Warehouses

In the world of business, assets are often celebrated as a sign of strength and stability. A robust balance sheet, brimming with tangible goods, can paint a picture of a thriving enterprise. However, beneath this seemingly prosperous surface lies a deceptive and insidious problem that plagues countless businesses: being "inventory rich, cash poor." This paradoxical situation, where a company holds significant value in its stock but struggles with liquidity, is a silent killer that can stifle growth, erode profitability, and ultimately lead to financial distress, even for seemingly successful ventures.

This article delves into the complexities of being inventory rich and cash poor, exploring its root causes, the profound consequences it unleashes, and the strategic solutions businesses can adopt to transform their inventory from a financial drain into a true asset that fuels sustainable growth.

The Deceptive Allure of Inventory

For many business owners, particularly in retail, manufacturing, and distribution, a well-stocked warehouse feels like a comforting safety net. It promises:

- Uninterrupted Sales: Never missing an opportunity due to stock-outs.

- Economies of Scale: Lower per-unit costs through bulk purchasing.

- Leverage with Suppliers: Stronger negotiation power.

- Readiness for Demand Spikes: Agility to respond to unexpected increases.

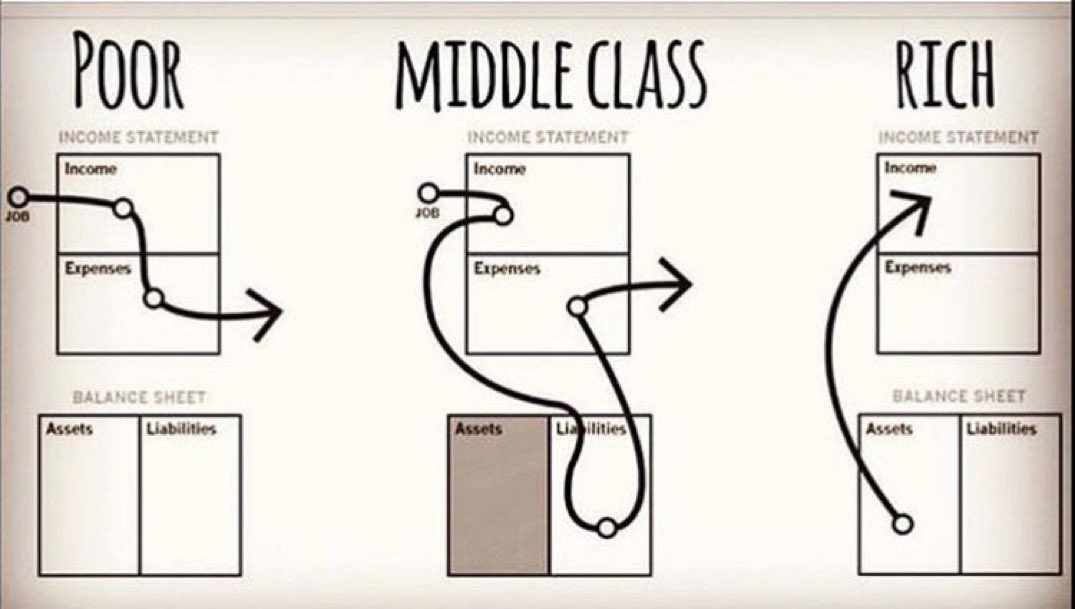

Inventory is recorded as a current asset on the balance sheet, contributing to a company’s net worth. On paper, a high inventory figure might even look impressive, suggesting a business with substantial resources. This perception, however, is often a mirage. While inventory is an asset, it’s a non-liquid one. It represents capital that has been spent but not yet recovered. Until that product is sold and the payment collected, it remains a frozen asset, incapable of covering operational expenses, investing in growth, or simply paying the bills.

Root Causes of the Inventory Trap

How do businesses fall into this perilous state? The path to being inventory rich and cash poor is often paved with good intentions and common operational missteps:

-

Poor Sales Forecasting: This is arguably the most significant culprit. Overly optimistic projections, a failure to account for seasonality, market shifts, or competitive pressures can lead to ordering far more than the market demands. Conversely, underestimating a product’s decline can leave a business with mountains of unsellable goods.

-

Chasing Volume Discounts & Bulk Purchases: While the allure of lower per-unit costs is strong, purchasing more than immediate needs dictate, just to secure a discount, often backfires. The savings in purchase price are quickly overshadowed by the costs of holding the excess inventory and the risk of obsolescence.

-

Long Lead Times: Businesses dealing with international suppliers or complex manufacturing processes often face extended lead times. To mitigate the risk of stock-outs, they tend to over-order, creating a buffer that can quickly swell into excess inventory if demand fluctuates.

-

Ineffective Inventory Management Systems: Lacking robust systems for tracking, analyzing, and optimizing inventory levels is a recipe for disaster. Manual processes, outdated software, or a complete absence of a system lead to blind spots, making it impossible to identify slow-moving items or accurately predict future needs.

-

Obsolescence and Perishability: In fast-paced industries (e.g., fashion, technology, fresh food), inventory can quickly become outdated, spoiled, or irrelevant. Holding onto such items, hoping they will eventually sell, only exacerbates the cash flow problem as their value rapidly diminishes.

-

Lack of Cross-Functional Communication: Often, sales, marketing, production, and finance departments operate in silos. Sales might push for more stock to ensure availability, production might focus on efficiency by running large batches, while finance grapples with the cash outflow. Without integrated planning, inventory levels become unmanageable.

-

Returns and Defective Goods: A high volume of customer returns or internally identified defective products can pile up in warehouses, tying up capital and requiring additional resources for processing, refurbishment, or disposal.

The Crippling Consequences

The impact of being inventory rich and cash poor extends far beyond mere inconvenience. It can cripple a business in multiple ways:

-

Cash Flow Strangulation: This is the most direct and severe consequence. Every dollar tied up in inventory is a dollar that cannot be used for:

- Paying suppliers, employees, or rent.

- Investing in marketing, R&D, or new equipment.

- Seizing new business opportunities.

- Weathering economic downturns.

A business can have millions in inventory but still face bankruptcy if it cannot meet its immediate financial obligations.

-

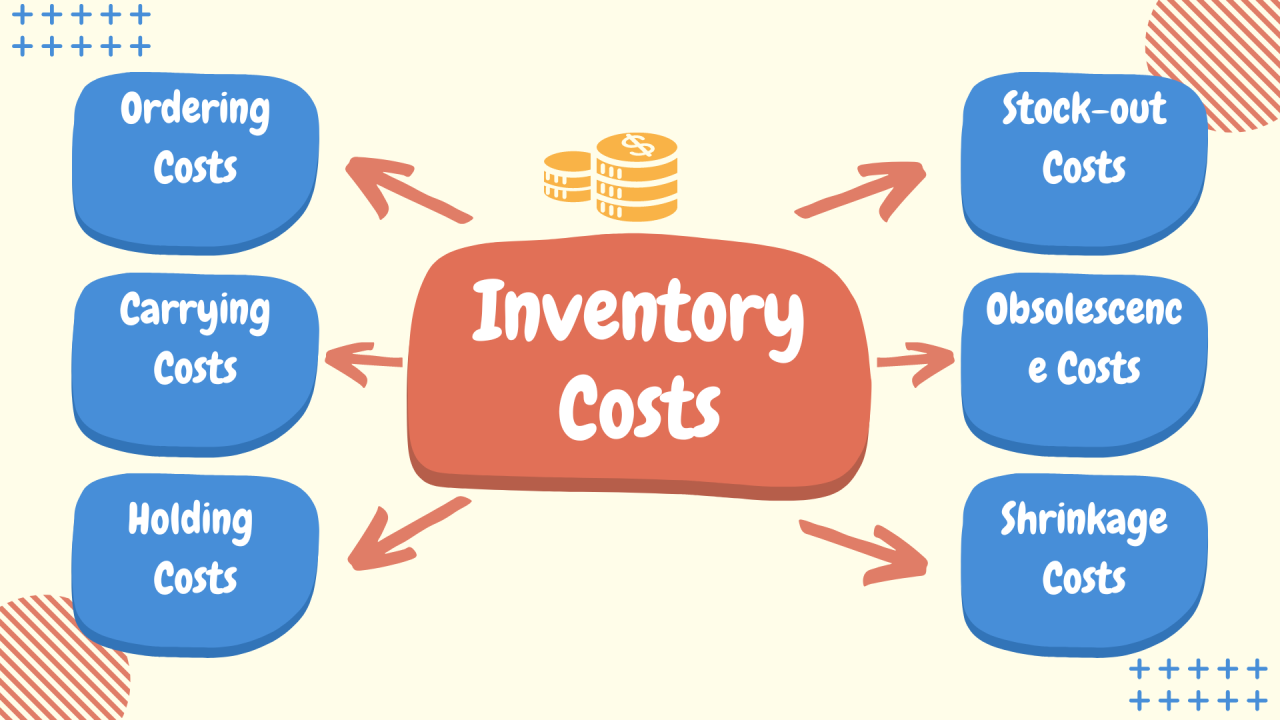

Exorbitant Holding Costs: Inventory isn’t free to store. These costs typically include:

- Warehousing: Rent, utilities, maintenance.

- Insurance: Protecting against damage, theft, or loss.

- Security: Personnel and systems to prevent shrinkage.

- Labor: Handling, counting, and organizing stock.

- Obsolescence Risk: The cost of goods that lose value or become unsellable.

- Damage/Spoilage: Losses due to physical deterioration.

These holding costs can range from 15% to 30% (or even higher) of the inventory’s value annually, significantly eroding profit margins.

-

Opportunity Costs: Capital trapped in excess inventory cannot be deployed elsewhere. This means missed opportunities for:

- Expanding product lines.

- Upgrading technology.

- Investing in employee training.

- Aggressive marketing campaigns that could drive sales.

The true cost isn’t just the money spent, but the potential gains forfeited.

-

Reduced Profitability: When excess inventory must eventually be cleared, it often involves deep discounts, clearance sales, or even selling below cost. These markdowns directly reduce gross margins and overall profitability. In the worst cases, inventory must be written off entirely, resulting in a direct hit to the bottom line.

-

Operational Inefficiencies: Large volumes of inventory can create logistical nightmares. Warehouses become cluttered, making it harder to locate items, increasing picking errors, and slowing down order fulfillment. This leads to increased labor costs and decreased customer satisfaction.

-

Financial Distress and Lender Skepticism: Banks and investors view excessive inventory with caution. It signals poor management, inefficient operations, and a higher risk of write-offs. Companies with high inventory and low cash are often seen as less creditworthy, making it harder to secure loans or attract investment for growth.

Identifying the Symptoms: Are You Inventory Rich, Cash Poor?

To diagnose this condition, businesses should regularly monitor key financial metrics and operational indicators:

- Inventory Turnover Ratio: How many times inventory is sold and replaced over a period. A low turnover ratio indicates slow-moving stock.

- Days Inventory Outstanding (DIO): The average number of days it takes for a company to turn its inventory into sales. High DIO means capital is tied up longer.

- Cash Conversion Cycle (CCC): Measures the time it takes for a company to convert its investments in inventory and accounts receivable into cash. A longer CCC is a red flag.

- Balance Sheet vs. Cash Flow Statement: Compare the value of inventory on the balance sheet to the cash flow from operations. A large disparity can indicate a problem.

- Physical Inspection: Are your warehouses overflowing? Is there dust on products? Are there significant quantities of old stock that haven’t moved in months or years?

Strategies for a Leaner, Cash-Rich Future

Escaping the inventory trap requires a multi-faceted approach, blending robust planning with efficient execution:

-

Master Demand Forecasting: Invest in advanced forecasting tools and methodologies. Utilize historical sales data, market trends, economic indicators, and even AI-driven analytics. Collaborate closely with sales and marketing teams to gain insights into future demand and promotions. Regularly review and adjust forecasts.

-

Implement Just-In-Time (JIT) Inventory: Adopt JIT principles, where inventory is received only as it is needed for production or sales. This minimizes holding costs and obsolescence risk. While challenging, JIT, popularized by Toyota, emphasizes strong supplier relationships and efficient logistics.

-

Optimize Ordering and Replenishment:

- Economic Order Quantity (EOQ): Calculate the ideal order quantity that minimizes total inventory costs (holding costs + ordering costs).

- Reorder Points: Establish clear reorder points and safety stock levels based on lead times and demand variability.

- Min/Max Levels: Set minimum and maximum stock levels for each SKU to prevent over-ordering while ensuring availability.

-

Leverage Technology: Implement or upgrade an Enterprise Resource Planning (ERP) system or a dedicated Inventory Management System (IMS). These systems provide real-time visibility into inventory levels, automate ordering, track sales trends, and integrate data across departments. Cloud-based solutions offer flexibility and scalability.

-

Strengthen Supplier Relationships: Negotiate with suppliers for smaller, more frequent deliveries. Explore options for consignment inventory, where the supplier retains ownership until the goods are sold, significantly reducing your capital outlay.

-

Strategic Liquidation of Excess Stock: Don’t let old inventory linger. Develop proactive strategies for clearing it:

- Discounting: Offer tiered discounts based on age or volume.

- Bundling: Combine slow-moving items with popular ones.

- Clearance Sales: Dedicated events to move old stock.

- Donation or Recycling: If all else fails, consider donating for tax benefits or recycling to recover some material value. The goal is to free up cash, even if at a reduced margin.

-

SKU Rationalization: Regularly review your product catalog. Identify and eliminate slow-moving or unprofitable SKUs. Focus resources on products that generate strong sales and healthy margins. "Less is more" can often apply to inventory diversity.

-

Cross-Functional Collaboration: Foster a culture of shared responsibility for inventory. Sales, marketing, production, and finance teams must communicate regularly and align on inventory goals. Integrated Business Planning (IBP) or Sales and Operations Planning (S&OP) processes are crucial here.

-

Regular Inventory Audits: Conduct periodic physical counts to reconcile with system records. This helps identify discrepancies, theft, damage, and ensures data accuracy, which is foundational for effective management.

Conclusion

Being "inventory rich, cash poor" is a dangerous tightrope walk that can lead even seemingly robust businesses to the brink. While inventory is an essential asset for most operations, its true value is realized only when it is efficiently managed and swiftly converted into cash. The illusion of wealth held in a warehouse can obscure critical cash flow problems, hindering a company’s ability to innovate, expand, and even survive.

By understanding the causes, recognizing the symptoms, and proactively implementing smart inventory management strategies, businesses can transform their inventory from a liability into a dynamic asset. The ultimate goal is not to eliminate inventory entirely, but to optimize it – holding just enough to meet demand efficiently, without tying up precious capital. In today’s dynamic business environment, cash flow remains king, and a lean, agile inventory strategy is paramount for sustainable growth and long-term financial health. The path to true prosperity lies not in the sheer volume of goods, but in their efficient movement and conversion into the lifeblood of any business: ready cash.