Unveiling the Business Inventory Offset Account: A Deeper Dive into Valuation and Financial Integrity

Inventory, for many businesses, represents a significant portion of their current assets. From raw materials and work-in-progress to finished goods, it is the lifeblood that fuels production, sales, and ultimately, profitability. However, the value of inventory is not static. It is constantly subject to various factors that can diminish its worth, such as obsolescence, damage, theft, and market price fluctuations. To accurately reflect the true economic value of these assets on the financial statements, businesses utilize a crucial, yet often misunderstood, accounting mechanism: the Business Inventory Offset Account.

While not a single, universally named account like "Accounts Payable" or "Sales Revenue," the concept of an "Inventory Offset Account" encompasses various contra-asset accounts specifically designed to reduce the carrying value of inventory. These accounts are indispensable for ensuring financial transparency, complying with accounting standards, and providing management with a realistic view of their asset base.

What is an Inventory Offset Account?

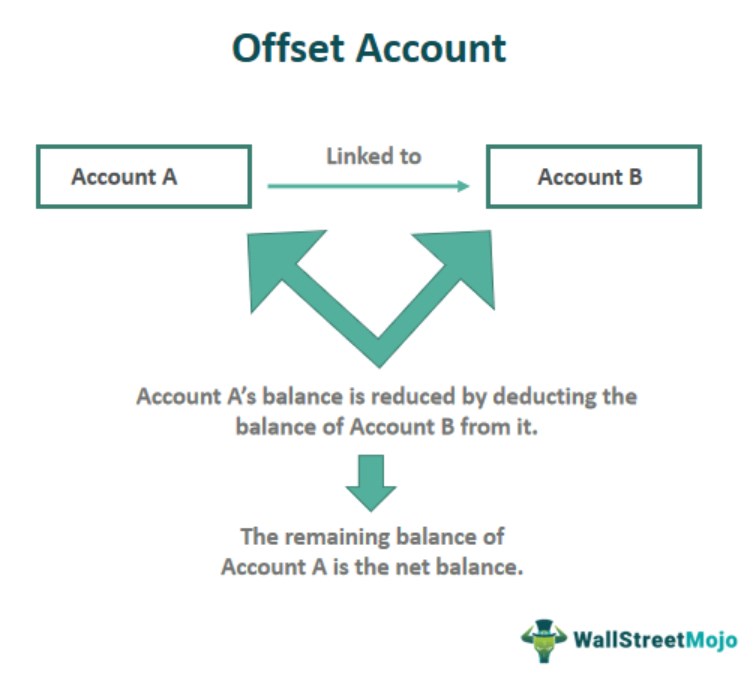

At its core, an inventory offset account is a contra-asset account that appears on the balance sheet alongside the primary inventory asset account. Its purpose is to reduce the gross value of inventory to arrive at a more accurate net realizable value (NRV) or to account for anticipated losses. Think of it as a reserve or an allowance against the historical cost of inventory.

The need for such accounts arises because generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) often require inventory to be initially recorded at its historical cost. However, these standards also mandate that assets should not be overstated on the balance sheet. If the future economic benefits of an asset are expected to be less than its historical cost, its carrying value must be reduced. This is where inventory offset accounts come into play. They act as a buffer, allowing the business to maintain the historical cost record while simultaneously presenting a more conservative and realistic valuation to external stakeholders.

Key Types of Inventory Offset Accounts

The "Business Inventory Offset Account" is an umbrella term for several specific allowance accounts, each addressing a different aspect of inventory value reduction. The most common types include:

1. Allowance for Inventory Obsolescence

Definition: This account is established to reduce the value of inventory that is deemed obsolete, slow-moving, or otherwise unlikely to be sold at its original cost. Obsolescence can occur due to technological advancements, changes in consumer preferences, expiration dates (for perishable goods), or simply a lack of demand.

Why it’s needed: Holding obsolete inventory ties up capital, incurs storage costs, and misrepresents the company’s financial health. Without an allowance, the balance sheet would show an inflated asset value, leading to an inaccurate picture of profitability and liquidity.

Accounting Mechanics:

- When inventory is identified as obsolete, an expense (e.g., "Cost of Goods Sold" or "Inventory Obsolescence Expense") is debited.

- The "Allowance for Inventory Obsolescence" account is credited.

- This entry reduces net income in the period the obsolescence is recognized and decreases the net carrying value of inventory on the balance sheet.

- When the obsolete inventory is eventually sold at a reduced price or written off, the allowance account is debited, and the inventory asset account is credited.

Example: A technology company has 100 units of a smartphone model that is now two generations old. The original cost was $500 per unit, but due to new models, it can now only be sold for $100. The company would recognize an obsolescence allowance of $400 per unit ($500 – $100).

2. Allowance for Inventory Shrinkage

Definition: This account addresses the reduction in inventory quantity or value due to factors other than sales. Common causes of shrinkage include theft (by customers or employees), damage, breakage, spoilage, administrative errors (e.g., miscounts, incorrect shipments), and loss.

Why it’s needed: Shrinkage is an unavoidable reality for most businesses, especially those dealing with high volumes or valuable goods. Accurately accounting for it ensures that the inventory reported on the balance sheet physically exists and is available for sale. Failing to account for shrinkage would lead to an overstatement of assets.

Accounting Mechanics:

- At regular intervals (e.g., monthly, quarterly, or during physical inventory counts), the estimated or actual shrinkage is calculated.

- An expense account (e.g., "Cost of Goods Sold" or "Inventory Shrinkage Expense") is debited.

- The "Allowance for Inventory Shrinkage" account is credited.

- This expense impacts the income statement, and the allowance reduces the net inventory value on the balance sheet.

- When the actual write-off occurs, the allowance account is debited, and the inventory asset account is credited.

Example: A retail store conducts a physical inventory count and finds that it has $5,000 less inventory than its perpetual records indicate. This $5,000 difference is attributed to shrinkage. The company would create an allowance for this amount.

3. Allowance for Inventory Write-Downs (Lower of Cost or Market/Net Realizable Value)

Definition: This allowance is used to adjust inventory’s carrying value down to its "market" value or "net realizable value" (NRV) when the market value falls below the historical cost. This is a fundamental principle in both GAAP (Lower of Cost or Market, or LCM) and IFRS (Lower of Cost and Net Realizable Value, or LCNRV).

- Market Value (GAAP): Generally refers to the replacement cost, but with upper and lower limits (ceiling and floor).

- Net Realizable Value (IFRS/GAAP): Estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale.

Why it’s needed: This principle prevents companies from overstating assets and ensures that potential losses are recognized in the period they occur, rather than when the inventory is finally sold. It adheres to the conservatism principle in accounting.

Accounting Mechanics:

- When the market value (or NRV) of inventory falls below its historical cost, an expense (e.g., "Cost of Goods Sold" or "Inventory Write-Down Expense") is debited.

- The "Allowance for Inventory Write-Downs" (or "Allowance to Reduce Inventory to Market") account is credited.

- This reduces net income and the net carrying value of inventory.

- If the market value recovers in a subsequent period (under IFRS, and under GAAP if the loss was recognized directly in COGS and not through an allowance, though this is less common for permanent write-downs), a reversal of the write-down may be permitted, up to the original cost.

Example: A manufacturer has inventory with a historical cost of $10,000. Due to a sudden drop in demand, the estimated selling price is now $9,000, and selling costs are $500. The NRV is $8,500. The company would create an allowance of $1,500 ($10,000 – $8,500).

The Importance of Inventory Offset Accounts

The strategic implementation and diligent management of inventory offset accounts offer numerous benefits beyond mere compliance:

-

Accurate Financial Reporting: They ensure that the balance sheet presents a truthful and conservative valuation of inventory, reflecting its true economic worth. This prevents asset overstatement and provides a more reliable picture of the company’s financial position.

-

Compliance with Accounting Standards: Both GAAP and IFRS mandate the recognition of inventory impairments. Offset accounts are the primary mechanism to achieve this compliance, avoiding potential audit qualifications and regulatory issues.

-

Informed Decision-Making: For management, these accounts provide critical insights into inventory health. High allowances for obsolescence might signal poor purchasing decisions or ineffective product life cycle management. Significant shrinkage allowances could point to weaknesses in internal controls or security. This data can drive strategic decisions regarding purchasing, pricing, production, and risk management.

-

Enhanced Investor Confidence: Transparent financial statements that accurately reflect potential losses build trust with investors, creditors, and other stakeholders. It demonstrates prudent financial management and a commitment to realistic reporting.

-

Improved Profitability Analysis: By recognizing losses in the period they occur, rather than deferring them until the inventory is sold or discarded, the income statement provides a more accurate representation of periodic profitability. This prevents artificial inflation of gross profit.

-

Better Inventory Management: The process of identifying items for allowance encourages businesses to regularly review their inventory, identify slow-moving or problematic stock, and take proactive measures such as clearance sales, rework, or disposal.

Accounting Mechanics and Financial Statement Presentation

When an inventory offset account is established or adjusted:

- Income Statement Impact: The corresponding expense (e.g., Obsolescence Expense, Shrinkage Expense, or Write-Down Expense, often categorized within Cost of Goods Sold) is recognized, reducing gross profit and net income for the period.

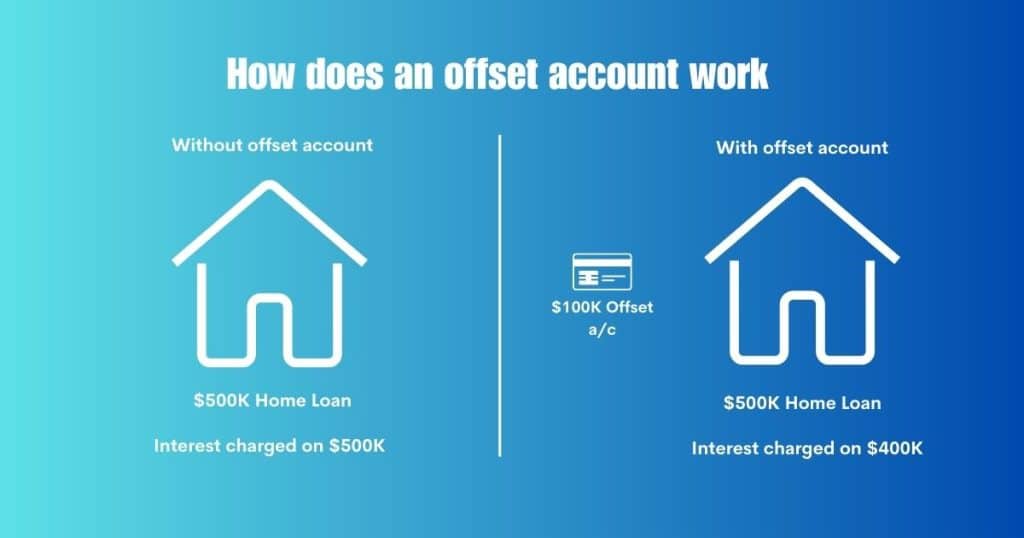

- Balance Sheet Impact:

- The primary "Inventory" account remains at its historical cost (gross).

- The "Allowance for " account appears as a negative amount directly below the gross inventory.

- The "Net Inventory" figure, which is the gross inventory less the total allowances, is the value presented to represent the asset’s current estimated realizable worth.

Example Balance Sheet Presentation:

| Assets | Amount |

|---|---|

| Current Assets: | |

| Inventory (at Cost) | $1,000,000 |

| Less: Allowance for Obsolescence | ($50,000) |

| Less: Allowance for Shrinkage | ($20,000) |

| Less: Allowance for Write-Downs | ($30,000) |

| Total Net Inventory | $900,000 |

Challenges and Best Practices

While essential, managing inventory offset accounts comes with its own set of challenges:

- Estimation Difficulty: The future is uncertain. Estimating obsolescence or shrinkage requires significant judgment and reliable data.

- Data Accuracy: The effectiveness of these allowances hinges on accurate inventory records, robust tracking systems, and regular physical counts.

- Subjectivity: Determining when an item becomes "obsolete" or what constitutes a "market" decline can be subjective, requiring clear policies and consistent application.

Best Practices:

- Implement Robust Inventory Management Systems: Utilize ERP systems, barcoding, and RFID technology to track inventory movement, sales patterns, and aging reports.

- Conduct Regular Physical Counts: Reconcile physical inventory with perpetual records to identify shrinkage and discrepancies.

- Establish Clear Policies: Define criteria for identifying obsolete, slow-moving, or impaired inventory. Specify approval processes for write-downs.

- Perform Regular Reviews: Periodically assess the adequacy of existing allowances. Adjustments may be needed based on changing market conditions or internal factors.

- Utilize Analytics: Employ data analytics to forecast demand, identify trends, and predict potential obsolescence or shrinkage more accurately.

- Engage Cross-Functional Teams: Involve sales, marketing, production, and finance teams in the assessment process to gain a holistic view of inventory health.

- Document Assumptions: Clearly document the assumptions and methodologies used to calculate allowances for audit purposes and internal consistency.

Conclusion

The Business Inventory Offset Account, in its various forms, is far more than a mere accounting formality. It is a critical tool for maintaining the integrity of a company’s financial statements, reflecting the true economic substance of its inventory assets. By diligently applying these contra-asset accounts, businesses not only comply with stringent accounting standards but also empower themselves with a more realistic understanding of their inventory’s value. This understanding is invaluable for making sound strategic decisions, managing risk, optimizing operations, and ultimately, building enduring financial health and stakeholder confidence. In a dynamic business environment, mastering the nuances of inventory valuation through offset accounts is a cornerstone of effective financial management.