Beyond the Shelf: Understanding the Complexities of Business Inventory Removed for Personal Use

In the bustling world of commerce, every item on a business’s shelf represents more than just a product; it embodies capital, potential revenue, and a carefully tracked asset. Yet, a common, often overlooked, practice can subtly undermine these fundamentals: the removal of business inventory for personal use. What might seem like a harmless perk for a small business owner, an impromptu convenience, or even a simple oversight, can quickly unravel into a complex web of financial, tax, ethical, and operational challenges. This article delves deep into the multifaceted implications of taking inventory from one’s business for personal use, offering insights into its pitfalls and advocating for best practices.

The Allure of the Accessible Asset

The motivation behind removing inventory for personal use is often benign, especially in small and medium-sized enterprises (SMEs). For a sole proprietor, the line between personal and business assets can blur easily. Imagine a hardware store owner needing a new drill for a home project, a fashion boutique owner taking a dress for an event, or a restaurant owner using ingredients for a family meal. The immediate convenience and perceived cost savings are powerful drivers. "It’s my business, so it’s my product," is a common sentiment.

However, this seemingly innocuous act carries significant weight that extends far beyond the immediate benefit. It impacts the accuracy of financial statements, creates tax liabilities, raises ethical questions, and can disrupt the very operations of the business.

The Financial Labyrinth: Distorting the Books

At the heart of the issue lies the misrepresentation of a business’s financial health. Inventory is a current asset on the balance sheet and a crucial component in calculating the Cost of Goods Sold (COGS) on the income statement. When an item is removed for personal use without proper accounting, several financial distortions occur:

- Overstated Inventory: The balance sheet will show a higher inventory value than what physically exists, making the company appear more asset-rich than it is. This can mislead investors, lenders, or potential buyers.

- Understated Cost of Goods Sold (COGS): If the cost of the removed item is not properly accounted for and removed from COGS, the COGS figure will be inflated. This, in turn, artificially reduces the reported Gross Profit and Net Income. While seemingly beneficial for reducing taxable income, this is precisely where tax problems arise.

- Inaccurate Profitability Metrics: Key performance indicators (KPIs) like gross profit margin, net profit margin, and inventory turnover ratios become skewed. These metrics are vital for strategic decision-making, pricing strategies, and assessing operational efficiency. Distorted figures lead to poor business decisions.

- Misleading Business Valuation: Should the business ever be valued for sale, investment, or succession planning, inaccurate financial statements due to unrecorded inventory removals will lead to an incorrect valuation, potentially causing significant financial losses or legal disputes.

The Tax Minefield: A High-Stakes Game

Perhaps the most critical and often overlooked consequence of removing inventory for personal use lies in its tax implications. Tax authorities universally view such actions with scrutiny, treating them as a form of undeclared income or an improper expense deduction.

- Income Tax: When inventory is taken for personal use, tax regulations in many jurisdictions (including the IRS in the U.S.) stipulate that the fair market value (FMV) of the item should be treated as income to the owner or individual who took it. If this income is not reported, it constitutes tax evasion. For a sole proprietor or partner, this amount adds to their personal taxable income.

- Cost of Goods Sold (COGS) Adjustment: The cost of the item removed must be subtracted from the business’s COGS. If it remains in COGS, the business is effectively deducting an expense for an item that was not sold to generate revenue, thus artificially lowering its taxable profit. This is a common audit trigger and can lead to penalties, interest, and back taxes.

- Sales Tax/Use Tax: Depending on the jurisdiction, if an item is removed for personal use, the business might be liable for sales tax on the item’s fair market value, as if it were sold to the owner. Some states impose a "use tax" on items purchased tax-free for resale but then converted to personal use. Failing to remit these taxes can lead to severe penalties.

- Self-Employment Tax: For sole proprietors and partners, the fair market value of the inventory taken for personal use, when considered as income, may also be subject to self-employment taxes (e.g., Social Security and Medicare taxes in the U.S.).

- Audit Risk: Unexplained inventory discrepancies are a major red flag for tax auditors. A discrepancy between physical inventory counts and recorded inventory can trigger an audit, which can be costly, time-consuming, and expose other potential issues.

The Ethical Quandary: Integrity and Fairness

Beyond the financial and tax ramifications, removing inventory for personal use without proper procedure raises significant ethical questions, particularly in businesses with multiple stakeholders.

- Fiduciary Duty: For corporations, officers and directors have a fiduciary duty to act in the best interest of the company and its shareholders. Taking inventory without proper payment or accounting can be seen as a breach of this duty, potentially leading to legal action from shareholders.

- Fairness to Partners/Shareholders: In partnerships or multi-owner businesses, one partner taking inventory for personal use without compensating the business essentially takes value from the other partners. This erodes trust and can lead to internal disputes.

- Employee Morale: If employees observe owners or managers freely taking items from inventory, it can create a perception of unfairness, lead to resentment, and even encourage other employees to engage in similar unauthorized removals, exacerbating the problem.

- Customer Trust: In the long run, if inventory management is so poor that items are frequently unavailable due to personal use, customer trust and loyalty can be damaged.

Operational Headaches: Disrupting the Flow

The impact isn’t just on the books and taxes; it extends to the day-to-day operations of the business:

- Inventory Discrepancies: Physical inventory counts will not match records, leading to confusion, wasted time investigating discrepancies, and difficulty in reconciling stock.

- Ordering and Stocking Errors: Inaccurate inventory data can lead to incorrect ordering decisions – either ordering too much (leading to obsolescence and carrying costs) or too little (leading to stockouts and lost sales).

- Lost Sales: If an item is taken for personal use and a customer later wants to purchase it, the business loses a potential sale and potentially a customer.

- Supply Chain Disruptions: Over time, consistent unrecorded removals can create a ripple effect throughout the supply chain, impacting relationships with suppliers and forecasting accuracy.

Best Practices and Proper Accounting Treatment

Given the extensive list of potential problems, it’s clear that a robust policy and strict adherence to proper accounting are essential.

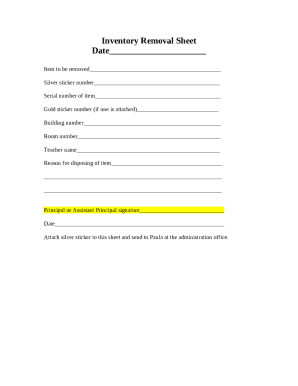

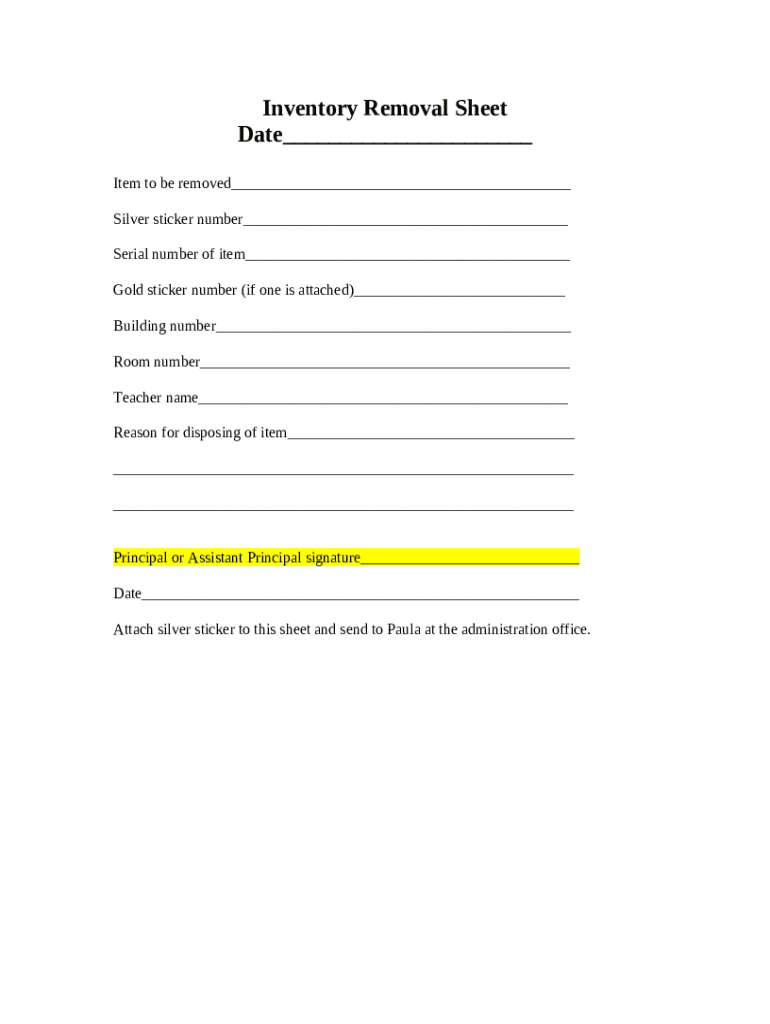

1. Establish Clear Policies:

- "No Personal Use" Policy: The simplest approach is to explicitly forbid the removal of inventory for personal use.

- "Employee Purchase" Policy: If personal use is allowed, establish a clear policy that requires owners and employees to purchase items at a predetermined price (e.g., cost, cost plus a small markup, or retail price).

2. Implement Robust Internal Controls:

- Segregation of Duties: Separate the responsibilities of ordering, receiving, and recording inventory. This reduces the opportunity for unauthorized removals to go unnoticed.

- Regular Inventory Audits: Conduct periodic physical counts and reconcile them with inventory records. Investigate discrepancies promptly.

- Strong Inventory Management System: Utilize software that tracks inventory movement in real-time, allowing for better visibility and accountability.

- Approval Process: Require management approval for any inventory removal that is not a standard sale.

3. Proper Accounting Treatment:

When an item is removed for personal use, it must be recorded in the accounting system to maintain accuracy and compliance. There are generally two primary ways to account for it, with one being far more advisable than the other:

-

Option A: Treat as a Regular Sale (Highly Recommended):

This is the cleanest and most compliant method. The owner or employee effectively "buys" the item from the business.- Debit: Cash or Accounts Receivable (if paid later) or Owner’s Draw/Distribution (if the owner isn’t paying cash directly).

- Credit: Sales Revenue (at the fair market value of the item).

- Debit: Cost of Goods Sold.

- Credit: Inventory (at the cost of the item).

- Sales Tax: Collect and remit sales tax on the FMV if applicable.

This method ensures the business accurately records revenue, COGS, and inventory, and the owner recognizes the "purchase" either by paying cash or having it deducted from their equity.

-

Option B: Record as an Owner’s Draw/Distribution (Less Ideal for Tax Purposes, but common for cost removal):

This method removes the item from inventory at its cost but doesn’t create a "sale" transaction for the business.- Debit: Owner’s Draw/Distribution (at the cost of the item).

- Credit: Inventory (at the cost of the item).

While this correctly removes the item from inventory and COGS, it’s crucial to remember that tax authorities often view the fair market value of the item as taxable income to the owner, even if it’s recorded as a draw internally. Therefore, Option A is generally preferred for its clarity and compliance with tax laws regarding personal benefits.

Cultivating a Culture of Transparency and Compliance

The issue of business inventory removed for personal use is a subtle yet significant challenge that can erode the financial health, legal standing, and ethical integrity of any business. While the temptation of convenience is understandable, the cumulative impact of such actions can be detrimental.

Business owners must recognize that their business is a distinct entity, even if they are its sole proprietor. Maintaining a clear separation between personal and business finances, including inventory, is paramount for accurate financial reporting, tax compliance, and sound decision-making. By implementing clear policies, robust internal controls, and proper accounting practices, businesses can navigate these complexities, protect their assets, and foster a culture of transparency and accountability that serves as the foundation for sustainable growth and long-term success.